Starting a new business in Canada as a newcomer is both exciting and accessible, thanks to its strong economy, supportive government programs, and a favorable business environment ranked 23rd globally in the World Bank's final Ease of Doing Business index (2020), with immigrants launching about 33% of all new businesses. However, navigating legal requirements, business culture, and resources can still feel complex if you're new to the country. This article guides you through essential steps, common pitfalls to avoid, and how to confidently launch your idea in your new home. Let’s get started.

How much money do you need to start a business in Canada

Starting a business in Canada as a newcomer requires varying amounts of capital depending on the model, scale, and location, but entry barriers remain low compared to many countries.

You can launch an online business with as little as $10 for a domain name and basic platform setup via tools like Shopify, scaling to $1,000–$5,000 for e-commerce with marketing and inventory.

If you want to start an offline business, costs rise in high-demand urban areas like downtown Toronto or Vancouver (e.g., $5,000+/month rent), but drop sharply in smaller cities or rural spots like Regina (under $1,000/month). Regional grants, such as up to $5,000 non-repayable funds in Ontario, Canada, help newcomers in pricier zones.

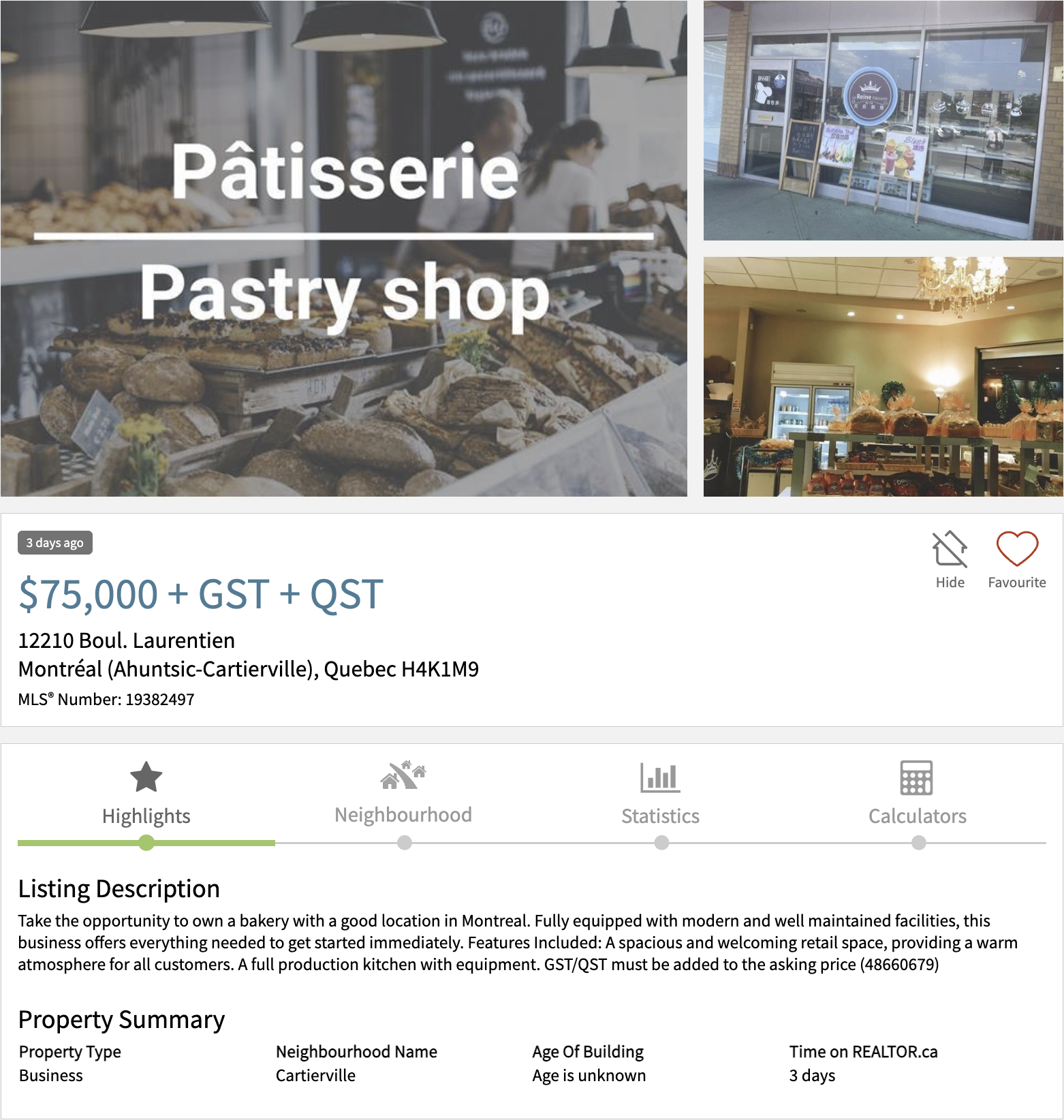

A simpler option is acquiring a "mom and pop" shop from retiring owners (about 40% of small businesses are owned by people aged 55 and above), listed on sites like realtor.ca for $50,000–$500,000 with ready cash flow and customers. Seller financing or BDC loans often cover 70–80%, reducing risk versus building from zero.

Below is a sample listing from realtor.ca for a pastry shop:

How to start a business in Canada as an immigrant?

Starting a business in Canada involves more than just a great idea. From planning and research to registration and banking, each step plays an important role in setting up a strong and compliant business foundation. Here’s how you can set up your own business in Canada as a new immigrant:

Plan your business

Before you register anything, take time to clarify your business idea. Ask yourself what problem your business solves, who your customers are, and how your product or service stands out. Planning early helps reduce risks, save money, and make informed decisions as you move forward.

Market research

Market research helps you understand your target audience, competitors, and industry trends in Canada. This includes analyzing customer needs, pricing, demand, and location preferences. For newcomers, market research is especially important to understand local consumer behavior and cultural differences that may impact buying decisions.

Conducting market research

Market research is commonly divided into primary and secondary research. Using both together helps businesses gain a clear and balanced understanding of their target market.

Primary Market Research | Secondary Market Research |

Primary market research involves collecting new data directly from potential customers to understand their needs, preferences, and behaviours. You can use Google or Facebook ads to gather data from your audience. | Secondary market research relies on existing data that has already been collected by others, offering a broader view of the market and industry trends. |

Physical vs online business

Decide whether your business will operate from a physical location, online, or both. A physical business may require leasing space and local permits, while an online business often has lower startup costs and broader reach. Your choice will influence registration requirements, taxes, and operating expenses. An online business can be started for as low as CA$10 ( the cost of a .ca domain name) but a physical business would certainly require a lot more money than that.

Starting an online business is a cost-effective way to test market demand and gauge interest in your product.

Business plan

A business plan is a roadmap for your business. It outlines your goals, target market, products or services, pricing strategy, marketing plan, and financial projections. A well-written business plan is often required if you are applying for loans, grants, or investors and helps you stay focused as your business grows. You also need a business plan to raise money from investors or the bank.

Choose a business structure

Choosing the right business structure affects your taxes, liability, and legal responsibilities. Common structures in Canada include sole proprietorship, partnership, and corporation. Each option has different requirements and benefits, so it’s important to choose one that aligns with your long-term goals and risk tolerance. Each of these structures has different tax and compliance requirements.

Structure | Liability | Taxes | Setup Cost/Ease |

Sole Proprietorship | Unlimited personal | Personal income rate | Low/simple |

Partnership | Unlimited (general) | Personal income rate | Low/simple |

Corporation | Limited | Corporate rate (lower) | Higher/complex |

Assess your risk tolerance, number of owners, and funding needs first. Start simple (sole prop) if solo and low-risk; go corporate for growth or investors. Consult a lawyer or accountant for your province's rules. Read more here.

Legal & registration

Once your planning is complete, you must ensure your business meets all legal requirements. This includes registering your business, securing permits and licenses, and complying with federal, provincial, and municipal regulations.

Business name

Your business name should be unique, memorable, and compliant with Canadian naming rules. Depending on your business structure and province, you may need to conduct a name search to ensure it’s not already in use.

Here’s how you go about deciding a business name:

Do a quick online search

Search your proposed business name on Google and social media to see if it’s already being used in Canada. This helps flag obvious conflicts early.Check national business name databases

Your business name must not be identical or confusingly similar to an existing registered business or trademark. You can use:

- NUANS to find similar or identical corporate names and trademarks

- Canadian business registries to check availability across federal and provincial jurisdictions (including Alberta, BC, Ontario, Quebec, and others)Search provincial business name registries

Each province has its own business name registry, and rules can vary by jurisdiction. Check the registries in any province where you plan to operate—especially if you’ll be doing business outside your home province. This includes:

- Alberta

- British Columbia

- Manitoba

- New Brunswick

- Newfoundland and Labrador

- Nova Scotia

- Ontario

- Prince Edward Island

- Quebec

- Saskatchewan

Trademarks / trade name

Registering a trademark helps protect your brand name, logo, or slogan from being used by others. A trade name is the name under which your business operates, which may be different from your legal name. While not mandatory, trademark registration offers long-term brand protection across Canada. It also ensures that the name you have selected has not already been registered and used by any other corporation.

A simple example is you will certainly face legal challenges if you want to start a business that sells phones with the name ‘Apple’, however you may or may not use ‘Apple’ for selling non-technology products.

To understand how trademarks fit into the bigger picture, it’s important to know the difference between a corporate name, trade name, trademark, and domain name. While these can overlap, they serve different purposes and are registered through different authorities.

1. Corporate name (Legal name)

This is the official legal name of your company when it is incorporated federally or provincially. It can be a unique word-based name or a numbered name.

What it is: The legal identity of your company

Where to get it: Corporations Canada or a provincial/territorial registry

Can also be: A trade name or trademark

Examples: 123456 Canada Inc. or Lismar Guitar Inc.

2. Trade name (Operating name)

A trade name is the name you use publicly when operating your business. It’s the name customers see on storefronts, signage, and invoices.

What it is: The name under which you conduct business

Where to get it: Provincial or territorial registry

Can also be: A corporate name or trademark

Example: Lismar Guitar Shop

3. Trademark (The brand)

A trademark protects the brand elements that distinguish your goods or services from others, such as names, logos, or slogans.

What it is: A sign or combination of signs identifying your brand

Where to get it: Canadian Intellectual Property Office

Can also be: A corporate name, trade name, or domain name

Example: Lismar Guitar

4. Domain Name (Your Internet Address)

A domain name is your website address and plays a key role in your online presence. Owning a domain does not automatically grant trademark or business name rights.

What it is: Your business’s website address

Where to get it: Domain registrar

Can also be: A trademark (if registered)

Examples: www.lismarguitarshop.ca or www.lismarguitar.com

Business registration & incorporation

You must register your business with the appropriate government authority, either provincially or federally. Incorporation provides legal protection by separating your personal assets from your business, while non-incorporated businesses are simpler and less expensive to set up. The government authority depends on where you want to conduct your business. If you operate in only one province or territory, you will generally register with that provincial or territorial authority. If you plan to do business across multiple provinces or nationally, you may need federal registration and additional provincial registrations to legally operate in each jurisdiction.

Permits & licenses

Depending on your industry and location, you may need specific permits or licenses to operate legally. These can include health permits, zoning approvals, or professional certifications. For example, to start a restaurant you will need a Safe Food for Canadians (SFC) Licence, Provincial Business Licence/Permit, Health Permit/Food Handling Permit and Food Handler Certification. Always check federal, provincial, and municipal requirements to stay compliant. Here’s how you can check that.

Business number (BN)

A Business Number (BN) is a unique identifier issued by the Canada Revenue Agency. It is used for taxes such as GST/HST, payroll deductions, import/export, and corporate income tax. Most businesses need a BN to operate and manage tax obligations.

Open a business bank account

Opening a dedicated business bank account helps separate your personal and business finances, making accounting and tax filing easier. Most Canadian banks require your business registration documents, Business Number, and personal identification. A business account also improves credibility with customers, suppliers, and financial institutions.

Having a business account also helps with tax compliance. It’s not recommended to use personal credit cards and accounts for business expenses as it may invite an audit from Canada Revenue Agency (CRA).

Financing and credit

Access to financing is one of the most important, and sometimes challenging, parts of starting a business in a new country. As a newcomer to Canada, understanding how the financial system works and how to build credit early can open doors to loans, grants, and other funding opportunities.

Build Canadian credit

Canadian credit history plays a major role in your ability to secure business financing. Even if you have strong credit in your home country, you’ll usually need to build credit from scratch in Canada.

To start building Canadian credit, consider opening a personal bank account and applying for a credit card as soon as you arrive. Using your credit card regularly and paying balances on time helps establish a positive credit record. Some banks offer newcomer or secured credit cards specifically designed for those with limited credit history. Maintaining low credit utilization and paying all bills on time will steadily improve your credit score and increase your eligibility for future business financing.

Funding options for newcomers

Canada offers a variety of funding options to support newcomer entrepreneurs. These include government grants and loans, small business financing programs, microloans, and support from community organizations. Federal and provincial programs often provide funding, training, and mentorship to help newcomers start and grow their businesses.

There are funds/ VCs who are accredited by the GoC who help newcomers with their business and small business grants.

Newcomers may also explore bank loans, credit lines, and alternative financing options such as angel investors or crowdfunding. While some traditional lenders may require Canadian credit history, many newcomer-focused programs are designed to be more flexible and supportive. Preparing a strong business plan and financial projections will significantly improve your chances of securing funding.

Support & networking

Building a business in a new country is much easier when you’re not doing it alone. Canada has a strong ecosystem of support, networking opportunities, and programs designed to help newcomers connect, learn, and grow their businesses with confidence.

Business networking

Business networking helps you build relationships with other entrepreneurs, industry professionals, suppliers, and potential clients. Attending networking events, workshops, trade shows, and local business meetups allows you to learn from others, gain referrals, and stay informed about market trends. For newcomers, networking is also a great way to understand Canadian business culture and establish credibility in your industry.

Here are a few networking opportunities to check out:

Chamber of commerce: Local chambers host events, workshops, mixers, and seminars where you can meet other business owners and professionals.

Indo-Canada Chamber Of Commerce: It is a non-profit, non-partisan organization that promotes individual initiative and supports members in contributing to Canada’s economic, cultural, and social development.

If you are a college student:

Alberta School Of Business Entrepreneurship Club: Entrepreneurship Club (eCLUB) is a University-wide student-run organization based at the eHUB (9007 HUB Mall) to support entrepreneurship initiatives across the University of Alberta.

LaSalle College Of Montreal: The Entrepreneurship Club at LaSalle College brings together students from the different schools who share a passion for entrepreneurship.

Mentorship opportunities

Mentorship can be a game-changer for newcomer entrepreneurs. A business mentor provides guidance, shares real-world experience, and helps you avoid common mistakes. Many mentorship programs in Canada pair newcomers with experienced entrepreneurs who offer advice on business strategy, finances, marketing, and growth. Having a mentor can accelerate your learning curve and boost your confidence as you navigate your new business environment.

How to access mentorship

Apply to National Programs: Join Futurpreneur.ca (ages 19–39) for 2 years of free one-on-one mentoring plus up to $60K financing—ideal for immigrants with business ideas; submit online profile for matching.

Regional Newcomer-Focused: ISANS.ca in Nova Scotia pairs immigrants with pros (24+ matches yearly); similar via MentorConnect.ca or SMARTstart in Alberta for occupation-specific guidance.

Specific pathways for newcomers

Canada provides targeted immigration pathways for entrepreneurs and self-employed newcomers, enabling business ownership and permanent residency (PR). These programs vary in requirements like investment, experience, and support letters, often leading to work permits or direct PR.

Start-up Visa Program (SUV)

This federal program targets innovative entrepreneurs with scalable ideas supported by designated organizations (e.g., venture capital funds). Applicants need CLB 5 language proficiency, settlement funds, and each applicant must own at least 10% of the voting rights. Together, the applicants and the designated organization must own more than 50% of the voting rights, excluding Quebec. Successful applicants gain PR upon approval.

Note: This program is paused as of Jan 1, 2026. Those with a valid 2025 commitment certificate must apply by June 30, 2026.

Self-employed persons program

A federal PR stream for cultural, artistic, or athletic professionals with 2+ years of self-employment experience. It requires a viable business plan, points assessment (experience, education, age, language), and settlement funds.

Note: This program is currently paused until January 2027.

Entrepreneur work permits (C11)

Under the International Mobility Program (LMIA-exempt), foreign owners can obtain a work permit by establishing a new or acquiring an existing Canadian business (50%+ ownership), issuing themselves a job offer, and demonstrating significant economic benefit via a business plan.

Intra-company transfer (ICT)

This LMIA-exempt work permit allows multinational executives or key staff to transfer to a Canadian parent, branch, subsidiary, or affiliate. Eligibility hinges on prior employment (1 year continuous for executives/specialized knowledge), with pathways to PR possible after 1-2 years.

Provincial nominee programs (PNP)

Provinces like BC, Ontario, and Alberta run entrepreneur streams requiring net worth (e.g., $300K-$600K), investments ($100K+), job creation, and language skills (CLB 4+). Nomination leads to PR after business establishment and performance agreements.

Owner-operator LMIA program

Requires applicants to own/control a Canadian business (senior role like CEO), hire at least one Canadian/PR worker, and prove economic benefits via LMIA approval. Leads to a work permit, often followed by PR applications through Express Entry or PNP.

Quebec immigrant investor program

Quebec's Immigrant Investor Program (QIIP) requires CAD $2M net worth, 2+ years management experience (past 5 years), Quebec Scale Level 7 French proficiency, and either a CAD $1M refundable investment or CAD $200K-$350K non-refundable contribution. Approval grants a CSQ for federal PR; active as of January 2026.

You can also come as a student/ worker, and along with your studies, you can start a business in the time you have to work off campus. This is not a straight pathway but can help you start something on the side that you can take full time once you get your permanent residence. College entrepreneurship cells offer free pitch coaching, co-working space, prototype funding ($5K–$25K grants), and investor intros, accelerating your venture while studying.

Free tax help for your business

The Canada Revenue Agency (CRA) provides free, personalized support for small business owners, self-employed individuals, and those earning rental income. Through its Liaison Officer service, entrepreneurs across Canada can receive one-on-one guidance to better understand their tax responsibilities. All visits are completely confidential, and any information shared is not disclosed to other areas of the CRA.

You can access the Liaison Officer service in two ways:

Request a personalized visit, available in person, by phone, or online through Microsoft Teams

Arrange an in-person seminar or an online webinar for your business group or association

During a visit or seminar/webinar, a liaison officer can:

Help you understand your tax obligations and identify potential business or rental deductions

Answer tax-related questions specific to your situation

Explain how to avoid common tax mistakes

Introduce useful CRA online tools and electronic services

Review basic bookkeeping principles and best practices

Show how to compare your business’s financial performance with industry benchmarks

For personalized visits, liaison officers also provide tailored recommendations to improve your bookkeeping system and offer practical suggestions for maintaining accurate books and records.

Additional resources

Starting a business in Canada is easier when you know where to find reliable information and support. The following resources can help newcomers access guidance, tools, and services throughout their entrepreneurial journey.

Government of Canada resources

The Government of Canada offers a wide range of free and low-cost resources to support small business owners and newcomers. These resources provide information on business registration, taxes, funding programs, hiring employees, and compliance requirements. Federal websites and programs also offer step-by-step guides, online tools, and learning materials to help entrepreneurs make informed decisions and avoid costly mistakes. Exploring government resources early can save time and help ensure your business meets all legal and regulatory obligations.

Local newcomer support services

In addition to federal resources, many provinces, cities, and community organizations offer newcomer support services tailored to immigrants and refugees. These services often include business training, mentorship, language support, networking opportunities, and assistance with funding applications. Local newcomer organizations understand regional markets and can provide practical, hands-on guidance to help you adapt to the Canadian business environment. Connecting with these services can give you personalized support and a strong local network as you build your business.